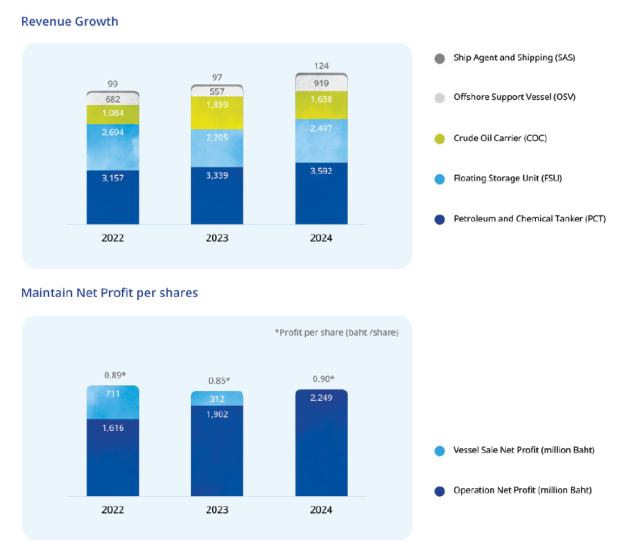

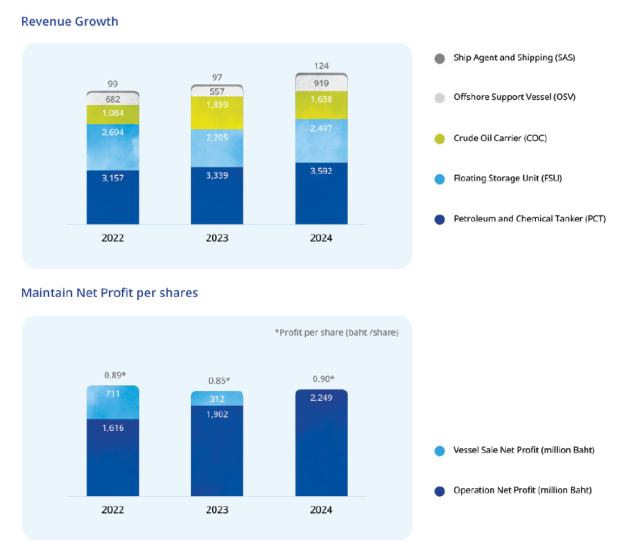

Revenue and net profit from continuous growth over the past 3 years, despite the sensitive economic environment, were impacted by geopolitical conflicts that led to trade barriers and technological development tensions between China and the United States, as well as the ongoing conflict between Ukraine and Russia, followed by the war between Israel and Hamas. These factors resulted in continuous fluctuation in global oil prices, which reflects the strength of the Company's business structure, allowing it to withstand the impacts of these environmental changes and deliver sustainable returns to shareholders as planned. Regarding the sale of old vessels that have reached the end of their useful life, the Company will manage to sell at the time align with the additional dry dock period and the readiness of new replaced vessels. This decision is also based on the market price of scrap metal, ensuring maximum benefit, as most old vessels are sold as scrap. In 2024, the Company sold a small old vessel at cost price, and it is expected that in 2025, 1-2 more old vessels will be sold.

In 2024, the Company gives precedence on investing in additional vessels, which will gradually enter service starting in 2025 under long-term contracts and enhancing the Company’s marketing efficiency and customer service in international markets to achieve its long-term strategic goals as follows:

OSV Business

- Investing in 2 Hybrid Crew Boats building to serve customers in the Middle East, with services commencing in January 2025, and 2 specially designed energy-efficient Crew Boats for domestic customers

- Investing in major refurbishments to upgrade the existing AWB vessels to meet higher service standards, ensuring readiness for contract renewal in mid-2025 at a higher rate.

- Investing in the conversion of a former Aframax crude oil tanker used for international transportation into a Floating Storage and Offloading (“FSO”) vessel. This will be under a long-term contract of 5 years + 5 years, starting in Q1/2025, ensuring long-term stable revenue growth for the OSV business.

PCT Vessel Business

- Investing in the acquisition of 1 additional petrochemical tanker in 2024, bringing the total petrochemical tanker fleet to 9 vessels, primarily serving customers in Malaysia, Vietnam, and Indonesia.

- Ordering 6 domestic oil tankers newbuilding with high efficiency, lower fuel consumption, and increased cargo capacity to gradually replace aging vessels that will reach the end of their operational lifespan in the next 1–2 years. This will bring the total domestic oil tanker fleet to 29 vessels, supporting the gradually increasing domestic demand while enhancing customer satisfaction with the fleet’s modernity and energy efficiency.

FSU Vessel Business

- Investing in the acquisition of 1 additional VLCC vessel to commence service for multinational oil trading companies starting in March 2025. The Company has set a policy for all 5 FSU vessels to serve oil traders who use them for storing and blending refined oil for sale to end users, including bunker fuel supply for commercial vessels in Singapore. As a result, revenue from FSU vessels remains stable compared to servicing customers who use them for speculative oil storage based on global crude oil price fluctuations.

Marketing and Management Capabilities Enhancement

- Expanding and developing marketing personnel to strengthen capabilities in expanding the international customer base, while enhancing knowledge and elevating safety standards. This includes comprehensive inspections of machinery and equipment on board, as well as incentivizing all crew members to prevent accidents and minimize operational errors. These efforts have enabled the Company to maintain high fleet management standards despite an increase in its total fleet from 56 vessels in 2021 to 65 vessels in 2024.

- In 2024, the company earned recognition for its vessel management from both governmental and private sector organizations, which are major oil traders, as follows

- Received the IESG Safety Award 2024, organized by the Industry Environmental Safety Group (IESG), with six awards in various categories

- Assessed on the oil tanker safety management potential, held by multinational and major domestic oil traders such as PTT, Chevron, and Shell, using the Ship Inspection Report Program (SIRE), a globally recognized safety assessment system reflect company’s adherence to international standards in vessel maintenance, equipment readiness, and safety management, acceptable for domestic and international customers.

- Awarded for excellence in reliable service, including environmental management, cargo safety, schedule accuracy, vessel quality, and crew performance, by major clients such as PTTEP, Thai Oil, and IRPC.

- In financial management, the Company gives precedence to maintains strict financial and investment discipline by carefully analyzing project returns and risks across all dimensions. This prudent approach has secured continuous financial support from various institutions for both project financing and working capital. As part of its financial strategy, the Company allocated funds for a Treasury Stock repurchase program in 2024. The Board of Directors extends its appreciation to all financial institutions for their continued support.

Furthermore, the Board of Directors has appointed the Corporate Governance and Sustainability Committee to supervise the Company's sustainable management practices, ensuring a comprehensive approach across Environment, Social, and Good Corporate Governance (ESG). This includes integrating sustainability development policies into business strategies, as demonstrated by the design of newbuilding vessels that prioritize fuel efficiency, greenhouse gas emission reduction, and enhanced safety and hygiene standards for both crew members and passengers. These efforts are balanced with investment return considerations to ensure fairness and optimal benefits for all stakeholders. As a result of these dedicated initiatives, the Company has achieved multiple recognitions in 2024, including:

- Certified as a Carbon Footprint Organization (CFO) by the Thailand Greenhouse Gas Management Organization (Public Organization), making it the first and only oil transportation company in Thailand to receive this certification.

- Achieved a 5-star or "Excellent" rating in corporate governance assessments for the sixth consecutive year.

- Certified as a member of the Thai Private Sector Collective Action Against Corruption (CAC) for the sixth consecutive year.

Lastly, on behalf of the Board of Directors, I would like to thank all shareholders, customers, suppliers, and related parties, in always supporting the Company’s operation. I also would like to thank all executives and employee for their dedicated teamwork, commitment, and determination working together in building a strong and sustainable organization. This effort is guided by the ESG policy framework, aiming to create appropriate benefits for all stakeholders.